Bank of Canada holds key interest rate at 5%, says things moving in right direction

Bank of Canada holds key interest rate at 5%, says things moving in right direction

The Bank of Canada has kept its main interest rate at 5% again, marking the sixth time it has done so since July. The bank is waiting to make sure that the decrease in inflation continues before it thinks about reducing rates.

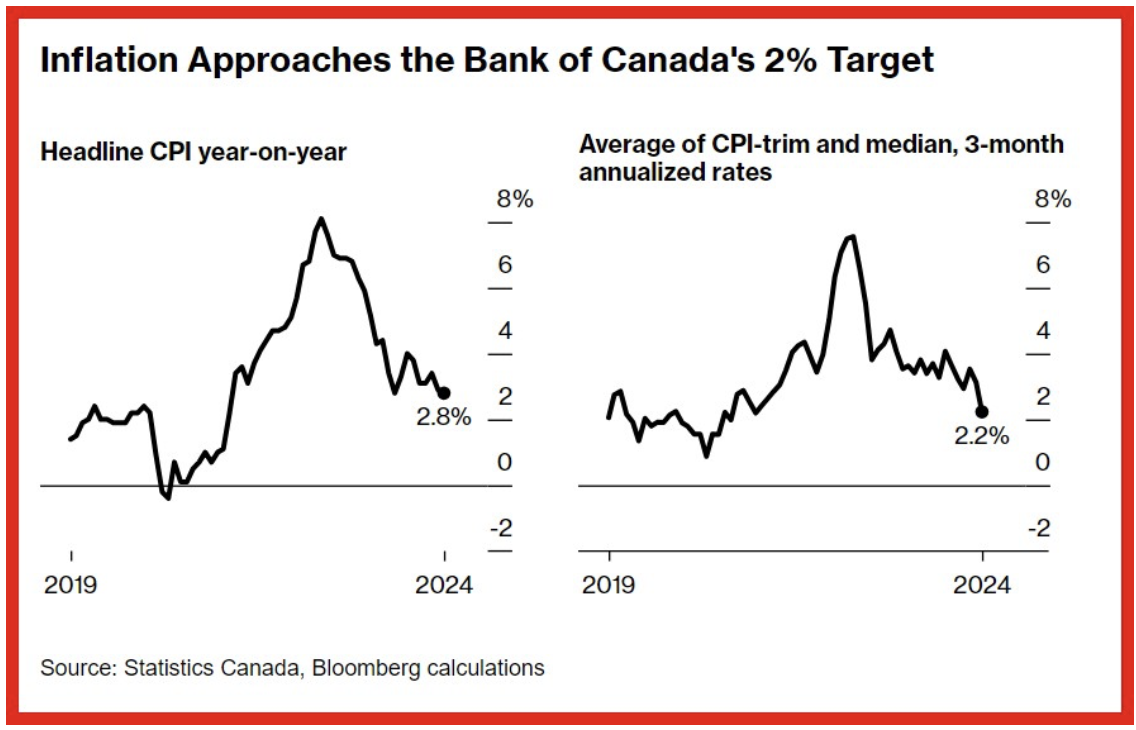

The bank also mentioned that overall prices are still rising too quickly, but when you ignore unstable areas like food and energy, the rate at which prices are going up has actually been dropping lately.

"I realize that what most Canadians want to know is when we will lower our policy interest rate. What do we need to see to be convinced it's time to cut?" Bank of Canada governor Tiff Macklem said during a news conference following the announcement.

"The short answer is we are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained. The further decline we've seen in core inflation is very recent. We need to be assured this is not just a temporary dip."

Macklem said that a rate cut in June is "within the realm of possibilities."

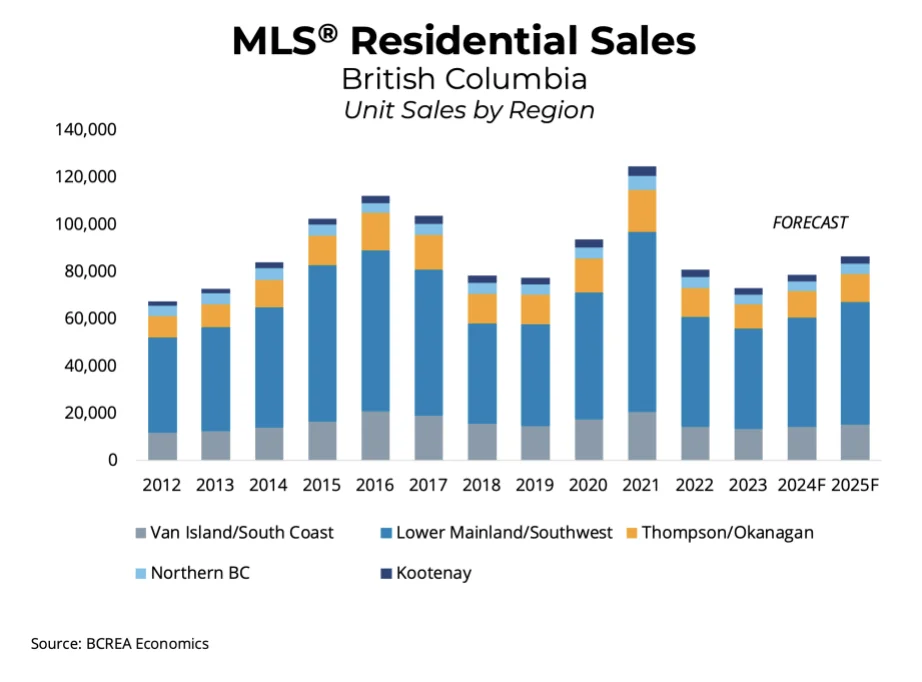

Inflation slowed down to 2.8% in February because things like food, clothes, and services got a bit cheaper, but high costs for renting and borrowing money for homes are still making inflation overall go up.

The bank thinks inflation will get closer to their goal of 2% sometime this year and should hit that target by 2025. They also predict the economy will grow well this year and in 2025, thanks to more people in the country and people spending more money.

"As we consider how much longer to hold the policy rate at the current level, we're looking for evidence that the recent further easing in underlying inflation will be sustained," Macklem said.

The Bank of Canada first raised interest rates in March 2022, the beginning of an aggressive campaign to cool inflation that resulted in 10 rate hikes in less than two years.

Bank just needs to see 'more of the same': economist

"It seems like the Bank of Canada is telling Canadians that rate cuts are on the horizon and it might not be so long before they become a reality," said economist Royce Mendes, managing director at Desjardins Capital Markets.

He said that the longer the bank holds interest rates at five per cent, the more it risks tipping the economy into an unnecessary recession.

Mendes added that he thinks the central bank will start cutting rates at its next meeting on June 5, and that it will continue to cut in small increments at subsequent meetings from then on.

"All they needed to see for rate cuts to become a reality was more of the same, which is really great news," Mendes said.

Economists predict that the Bank of Canada will start lowering interest rates before the U.S. Federal Reserve does because the economies of the two countries are showing different trends.

"The U.S. economy right now is extremely strong, whereas the Canadian economy is struggling," Mendes said.

The U.S. economy expanded quicker than anticipated in the last part of the year, and Canada's economy kicked off 2024 strongly, rebounding from a previous downturn.

In March, the rate of price increases in the U.S. went up by 0.4 percent once again, delaying expectations of a reduction in interest rates till later in the year.

Macklem mentioned that he doesn't think the inflation in the U.S. will greatly affect Canada.

Categories

Recent Posts