BC Economy Forecast 2025: It’s really Interesting

As we move through 2024, the data aligns with our long-standing expectation that the Atlantic Region and the Prairies would lead the country in GDP growth. Ontario, Quebec, and British Columbia continue to lag behind, though Ontario and Quebec have received upward growth revisions for 2024, leaving B.C. as the weakest performer.

Consumer spending has remained strong across Canada, particularly in Ontario, Quebec, and the Atlantic region. Looking ahead, lower-than-expected borrowing costs are set to boost household spending more than initially thought. However, heavily indebted households, especially in Ontario and B.C., will face challenges with mortgage renewals at much higher rates.

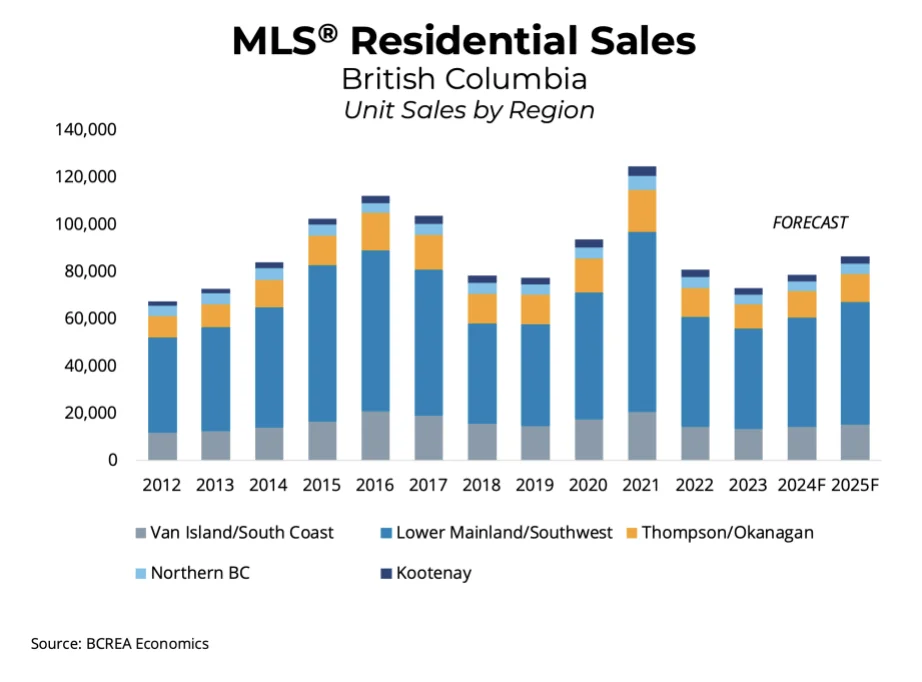

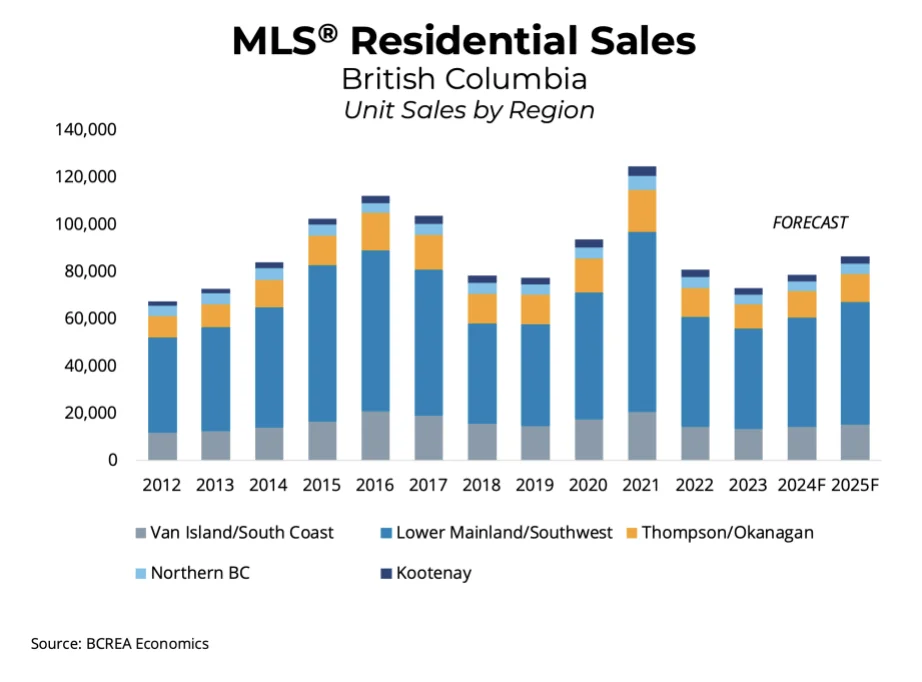

The housing market is also likely to benefit from lower interest rates, prompting us to raise our home price forecasts for 2024 and 2025 in most provinces. Ontario is the exception, where affordability issues and challenges in the condo market are expected to weigh on growth. While lower rates will also support home building, we still anticipate housing starts to decline through 2025 due to slower home sales in recent years.

As of the second quarter of 2024, Canada’s population growth remains strong, particularly in the four largest provinces, which have yet to feel the impact of new federal policies aimed at reducing the number of non-permanent residents. We expect these policies to slow population growth starting in late 2024, which could ease labour force expansion.

Employment gains have not kept pace with the growing labour force this year, pushing the national unemployment rate to its highest level since mid-2021. The biggest increases in unemployment have been seen in Ontario, Alberta, and Quebec. With population growth expected to slow, the jobless rate is likely to peak at year’s end before gradually easing in 2025.

Weak economic data from China has softened the outlook for crude oil demand, leading us to slightly lower our short-term oil price forecast. However, this adjustment is minor and won’t significantly alter the growth outlook for oil-producing provinces. In the Prairies, there is also concern over canola exports due to a one-year anti-dumping investigation launched by China.

B.C.'s economy is expected to lag behind the national average this year, primarily due to the pressure on consumer spending caused by interest rate hikes in 2022-23. Unlike most provinces, B.C. experienced a decline in retail sales during the first half of the year, and internal TD data indicates cautious spending trends continued into the third quarter. A key factor is the province's high household debt—the highest in Canada—particularly mortgage debt, which is making it harder for consumers to spend as many mortgages are set to renew at higher rates this year.

Looking ahead, the economic outlook improves over the next 12-18 months as the Bank of Canada gradually reduces interest rates. Although the benefits will take time to be fully realized, we expect spending to pick up by the first half of 2025, helping B.C. return to its position as a strong performer. In the housing market, recent interest rate cutstotalling 75 basis points have already sparked a slight rise in home buying activity, with stronger growth in home sales anticipated in the coming months.

Externally, the situation is mixed. The U.S. Department of Commerce recently doubled tariffs on Canadian softwood lumber, posing challenges for B.C.'s forestry sector, which accounts for a significant 12% of the province's exports. However, natural gas production is seeing gains, supported by a somewhat positive outlook for natural gas prices and the upcoming launch of LNG Canada next year.

B.C.'s job market has remained relatively strong this year. Employment grew by 2.6% year-over-year as of August, nearly matching the province's rapid labour force growth, which has helped keep B.C.’s unemployment rate the third lowest in the country. However, the job growth has been largely driven by public sector hiring, while private sector employment has lagged behind.

In its first-quarter fiscal report, the B.C. government projected a larger-than-expected deficit of about $9 billion (over 2% of GDP) for the current year, with no clear plan for balancing the budget. As the deficit and debt rise, the government's ability to maintain its spending programs is becoming more limited. Nevertheless, the government continues to push forward with its ambitious spending agenda, which has supported short-term economic activity. It's worth noting that the next provincial election is scheduled for October 14th.

Categories

Recent Posts