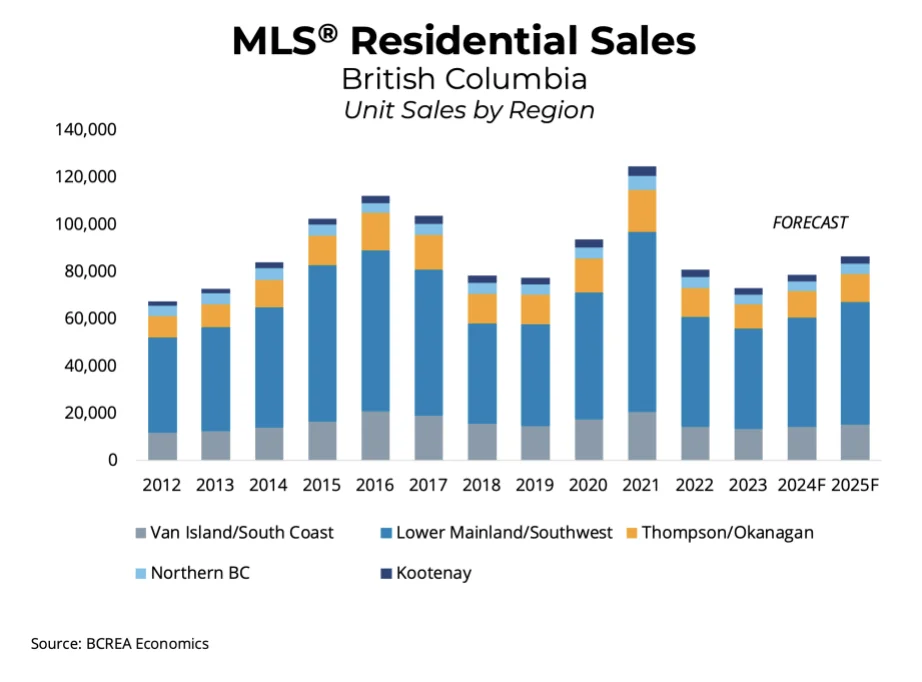

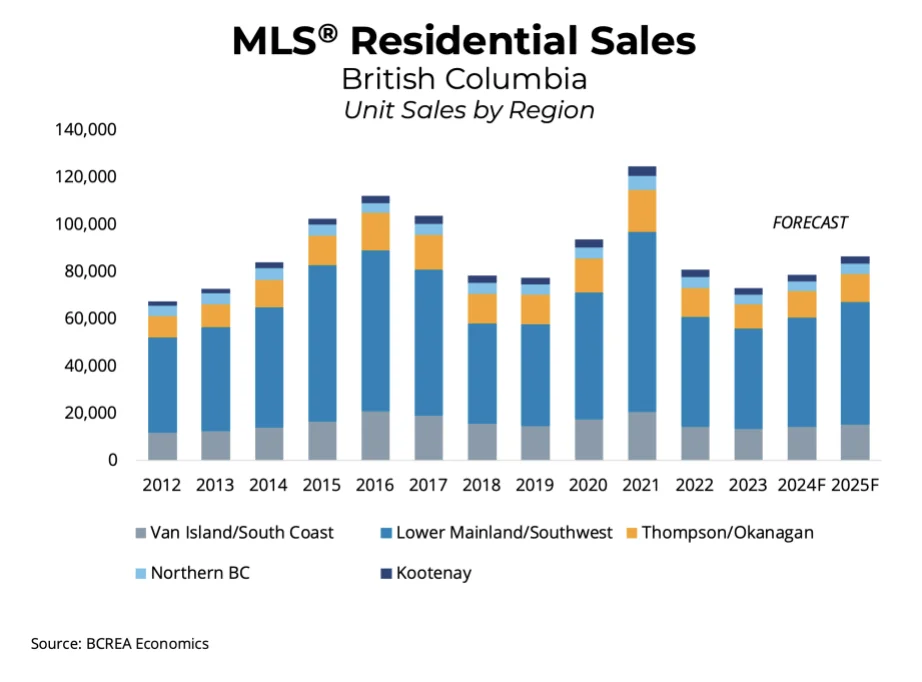

BC Economy Forecast 2025: It’s really Interesting

As we move through 2024, the data aligns with our long-standing expectation that the Atlantic Region and the Prairies would lead the country in GDP growth. Ontario, Quebec, and British Columbia continue to lag behind, though Ontario and Quebec have received upward growth revisions for 2024, leaving

Read MoreCanada's Mortgage Delinquency Rates on the Rise: What It Means for Homeowners

Canada's Rising Mortgage Delinquency Rates: What You Need to Know The Canadian housing market is facing a new challenge—rising mortgage delinquency rates. With high interest rates, increasing debt levels, and economic uncertainty, more homeowners are struggling to keep up with their mortgage paym

Read MoreFraser Valley Housing Market Statistics: January 2025

Fraser Valley's Decade-High Housing Inventory Presents Opportunities for Buyers Surrey, BC – January 2025 The Fraser Valley real estate market is experiencing a significant rise in inventory, creating potential opportunities for buyers despite ongoing economic uncertainty. Housing Invent

Read MoreHow US-Canada Trade Tariffs Could Impact Canada’s Housing Market in 2025

How US-Canada Trade Tariffs Could Reshape Canada’s Housing Market in 2025 The US-Canada trade relationship, one of the largest and most interconnected in the world, is facing renewed tension as trade tariffs loom on the horizon. With the potential for escalating tariffs in 2025, Canada’s housing ma

Read MoreCanada Housing Market 2024: Trends and Predictions

Canada Housing Market: 5 YEAR Trends and Predictions Canadian Real Estate Market Outlook: What to Expect in the Next Five Years Predicting the future of the real estate market is a bit like trying to guess the outcome of a thrilling hockey game—it’s full of surprises! If we had the power to see ah

Read MoreBank of Canada holds key interest rate at 5%, says things moving in right direction

Bank of Canada holds key interest rate at 5%, says things moving in right direction The Bank of Canada has kept its main interest rate at 5% again, marking the sixth time it has done so since July. The bank is waiting to make sure that the decrease in inflation continues before it thinks about redu

Read MoreBudgeting for closing, moving and move-in costs

How often have you gone for an oil change expecting a $50-$100 bill but ended up paying much more for additional services like wiper replacements, air filters, or brakes? Buying a house in British Columbia can be similar—it's more than just the purchase price. Understanding the true cost of buy

Read More10 Essential Tips for First-Time Home Buyers: From Budgets to Bidding Wars

Hey there, first-time home buyers! 🎉 So, you've decided to take the plunge into the exciting world of homeownership. Congratulations! You deserve a round an aplause. 🥳 But before you start envisioning backyard barbecues and mountain views, let's talk about the essential steps you need to take to

Read MoreHow to Choose the Perfect Neighborhood for Your New Home | Ultimate Guide

Buying a home is one of the most significant decisions you'll make, and choosing the right neighborhood is just as important as picking the right house. The neighborhood you choose will impact your lifestyle, your family's happiness, and the future value of your property. Here’s a guide to help you

Read MoreMortgage Pre-Approval - The Most Important Step

Understanding the Importance of Mortgage Pre-Approval When buying a home, obtaining a mortgage pre-approval is a crucial step. Why Get a Mortgage Pre-Approval? A mortgage pre-approval provides a clear understanding of the home price you can afford, helping you budget effectively and focus your hom

Read MoreIs It Safe to Live Near Power Lines? Understanding the Facts

Is It Safe to Live Near Power Lines? Understanding the Facts If you're searching for a home in Greater Vancouver or anywhere in British Columbia, you've probably come across properties located near power lines. You may love a particular home, but the sight of power lines nearby might leave you quest

Read More

Categories

Recent Posts